Dive into the realm of Global Oil Market Prices & Future Outlook where trends, history, and predictions collide to paint a vivid picture of the complex world of oil pricing. Let's unravel the mysteries and dynamics that shape this crucial market.

The following paragraphs will delve into the current trends, historical patterns, future projections, and key players in the global oil market landscape.

Overview of Global Oil Market Prices

The global oil market prices are constantly influenced by various factors, leading to fluctuations in prices. These fluctuations impact economies, industries, and consumers worldwide.

Current Trends in Global Oil Market Prices

- The current trends in global oil market prices show volatility due to factors such as supply disruptions, geopolitical tensions, and changes in demand.

- Oil prices have been affected by the COVID-19 pandemic, leading to a decrease in demand and oversupply in the market.

- Recent efforts by oil-producing countries to stabilize prices through production cuts have helped in balancing the market.

Factors Influencing Oil Prices Globally

- Supply and demand dynamics play a crucial role in determining oil prices. Any imbalance in supply or demand can lead to price fluctuations.

- Geopolitical events, such as conflicts in oil-producing regions or sanctions on major oil-producing countries, can disrupt supply and impact prices.

- Economic conditions, currency fluctuations, and global economic growth also influence oil prices, reflecting changes in market sentiment and investor confidence.

Role of Geopolitical Events in Oil Market Prices

- Geopolitical events, such as wars, conflicts, or sanctions, can lead to supply disruptions or changes in market sentiment, causing oil prices to rise or fall.

- Instability in major oil-producing countries or regions can create uncertainty in the market, leading to speculative trading and price volatility.

- Political decisions impacting oil production or distribution can have a direct impact on global oil prices, affecting both producers and consumers.

Supply and Demand in Determining Oil Prices

- The balance between supply and demand is a critical factor in determining oil prices. When supply exceeds demand, prices tend to fall, while a shortage in supply can lead to price increases.

- Changes in global economic conditions, industrial activities, and transportation trends can influence oil demand and subsequently impact prices in the market.

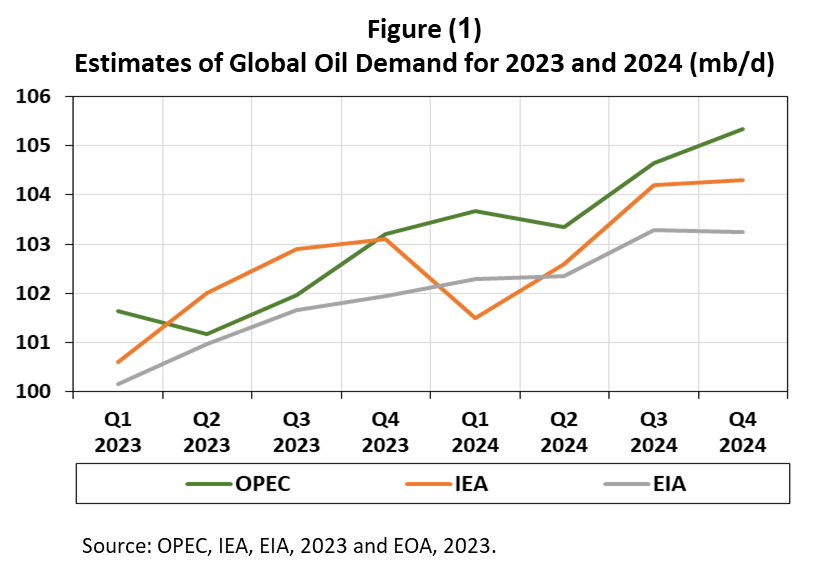

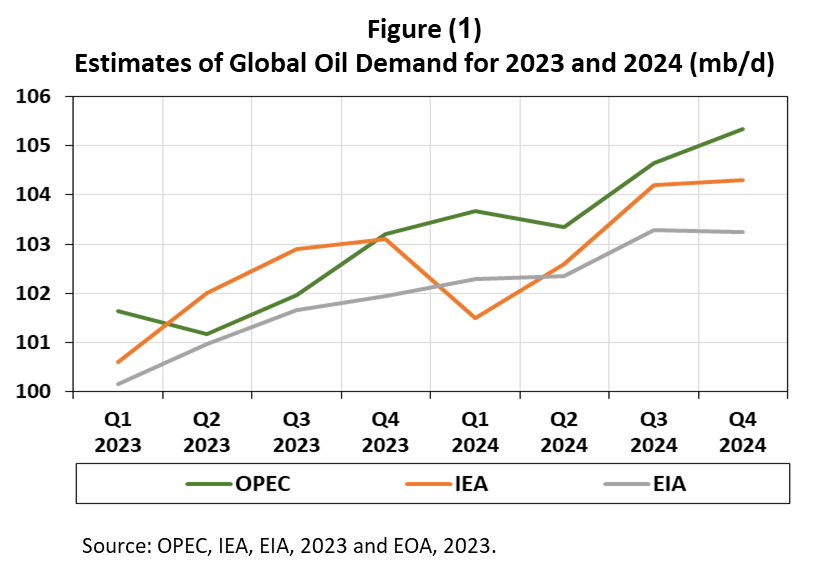

- Production decisions by major oil-producing countries, such as OPEC and non-OPEC members, also play a significant role in shaping supply levels and price movements in the oil market.

Historical Trends in Oil Prices

The global oil market has witnessed significant fluctuations in prices over the past decade, influenced by various economic, geopolitical, and environmental factors.

Economic Recessions Impact on Oil Prices

Economic recessions often lead to a decrease in demand for oil as industries slow down and consumers reduce spending. This reduction in demand causes oil prices to fall as supply outweighs demand. For example, during the 2008 financial crisis, oil prices plummeted from over $140 per barrel to around $30 per barrel due to the sharp decline in global economic activity.

Impact of Major Events on Oil Prices

Major events such as wars and pandemics have historically had a significant impact on oil prices. For instance, the Gulf War in 1990 led to a spike in oil prices due to concerns over supply disruptions in the Middle East.

Similarly, the outbreak of the COVID-19 pandemic in 2020 caused a sharp decline in oil prices as lockdown measures resulted in a drastic drop in demand.

Oil Price Volatility and Market Dynamics

Oil price volatility has played a crucial role in shaping market dynamics, affecting investment decisions, production levels, and global trade. For example, the uncertainty surrounding oil prices can lead to fluctuations in exploration and production activities, impacting the overall supply of oil in the market.

Additionally, sudden price spikes or drops can influence consumer behavior and government policies related to energy

.

Future Outlook of Global Oil Market Prices

The future outlook of global oil market prices is subject to various factors that can influence the direction of prices in the coming years.

Potential Scenarios for Oil Prices in the Next 5 Years

- The price of oil could rise due to geopolitical tensions or supply disruptions in major oil-producing regions, leading to higher demand and limited availability.

- Alternatively, a global economic slowdown or increased production from key oil players like OPEC could lead to a decrease in oil prices.

- Technological advancements in extraction methods may also impact oil prices by altering supply dynamics.

Impact of Renewable Energy Sources on the Future of Oil Prices

- The growing adoption of renewable energy sources such as solar and wind power could reduce the reliance on oil for energy generation, potentially lowering demand and putting downward pressure on oil prices.

- Government policies promoting renewable energy and reducing carbon emissions could further accelerate this shift away from oil, impacting its long-term price trajectory.

Technological Advancements and Their Influence on Oil Market Prices

- Advancements in technologies like hydraulic fracturing and horizontal drilling have enabled the extraction of previously inaccessible oil reserves, increasing global supply and potentially stabilizing or lowering prices.

- Innovation in electric vehicles and battery storage could also reduce the demand for oil in transportation, impacting oil prices in the future.

Evaluation of the Sustainability of Current Oil Price Levels in the Long Term

- The sustainability of current oil price levels in the long term depends on a delicate balance between supply, demand, geopolitical factors, and market dynamics.

- Factors such as the transition to cleaner energy sources, global economic trends, and regulatory changes will play a crucial role in determining the future sustainability of oil prices.

Key Players in the Global Oil Market

Oil is a crucial global commodity, and the market is influenced by various key players. Let's delve into the major oil-producing countries, the role of OPEC, strategies of major oil companies, and the impact of emerging markets.

Major Oil-Producing Countries and Their Influence

- Saudi Arabia: Largest oil producer in OPEC, plays a significant role in setting global oil prices.

- United States: Increased shale production has made the US a major player in the oil market.

- Russia: One of the top oil producers globally, influences oil prices through its production levels.

Role of OPEC in Regulating Supply and Prices

- OPEC: Organization of the Petroleum Exporting Countries, controls a large portion of global oil reserves and production.

- Production Cuts: OPEC's decisions on production levels directly impact oil prices worldwide.

- Market Stability: OPEC aims to maintain stability in oil prices through supply regulation.

Strategies of Major Oil Companies

- Diversification: Major oil companies invest in renewable energy sources to adapt to market changes.

- Cost Efficiency: Companies focus on cost-cutting measures to remain competitive during price fluctuations.

- Mergers and Acquisitions: Strategic partnerships and M&A activities help companies navigate market challenges.

Emerging Markets' Impact on the Global Oil Market

- Growing Demand: Emerging economies like China and India drive the demand for oil globally.

- Market Expansion: Emerging markets offer new opportunities for oil producers to expand their operations.

- Price Volatility: Changes in emerging markets can lead to fluctuations in global oil prices.

Conclusive Thoughts

As we wrap up our exploration of the Global Oil Market Prices & Future Outlook, it becomes clear that the intricate dance between supply, demand, geopolitics, and innovation will continue to shape the trajectory of oil prices in the years to come.

Stay tuned for more developments in this ever-evolving market.

Answers to Common Questions

What are the major factors influencing global oil prices?

The factors include supply and demand dynamics, geopolitical events, economic conditions, and technological advancements.

How do renewable energy sources impact the future of oil prices?

Renewable energy sources can reduce the reliance on oil, potentially leading to lower demand and impacting oil prices in the long term.

What is the role of OPEC in regulating global oil supply and prices?

OPEC, as a major oil-producing group, plays a significant role in coordinating production levels to influence oil prices globally.

How do major oil companies respond to market price fluctuations?

Major oil companies often adjust their production levels, explore new technologies, and diversify their portfolios to mitigate the impact of price fluctuations.

How are emerging markets shaping the global oil market landscape?

Emerging markets are becoming key players in driving oil demand and influencing market dynamics as their economies grow.

The following paragraphs will delve into the current trends, historical patterns, future projections, and key players in the global oil market landscape.

The following paragraphs will delve into the current trends, historical patterns, future projections, and key players in the global oil market landscape.